29 ago 2023

Customers are a valuable source of knowledge for any marketer. To learn what they think, how they feel, and how they behave, we can use Market Research Interviews. This tool of market research can help you collect valuable quantitative or qualitative information about your potential or existing customers.

Market research interviews are helpful for making right marketing decisions on expanding to new markets, launching new products, or changing the way a product or service is promoted.

Marketing research process identifies a set of practices used by a company to study its target market.

Market research process can help you with the following activities:

Study your competitors

Understand your current customers

Identify and study potential customers

Learn about new niches or markets

Keeping up with trends

Developing and introducing new products/services

Rebranding & changing marketing strategies

Altering the existing products/services

Creating or changing your positioning

Transform Your Market Research with Noty.ai

Discover the next level of efficiency in your market research interviews. Utilize Noty.ai to capture and analyze insights like never before. Say goodbye to manual note-taking and hello to enhanced productivity.

Start using Noty.ai AI meeting notes today!

Types of Market Research

Primary market research

A business studies market, its trends, and TA, using surveys, interviews, etc. It requires a large budget, time and dedicated specialists.

Secondary market research

A business uses existing market research (from several sources) to compile one document. It is usually conducted when the budget for research is tight.

Methods of market research

Interviews

Surveys

Roundtables

Focus Groups

Observation

Reporting

Goals of marketing research process

Make marketing decisions, like launching a new product, targeting a new market, etc.

Identify new opportunities for business

Provide information for potential investors

Mitigate business risks and avoid mistakes

Benefits of marketing research process

Data-driven marketing

Better understanding of your competitors, products, and TA.

The ability to cater your marketing activities to meet the customer needs.

Better planning and ability to improve ROI of marketing activities.

Steps in marketing research process

Outline the subject you’re going to research. For example, we need to study the features that the competing tools provide.

Develop the playbook for your research. It will contain the subject of research and the type of data you need to gather, the methods (e.g., interview), the necessary resources (time, budget), the timeline, and the step-by-step plan.

Approve the plan with top management and allocate the necessary resources.

Implement the research plan and gather the data.

Analyze the data and develop your recommendations for the business.

Present the marketing research to the management.

Market research interview is one of the tools of market research that enables you to learn the feelings, opinions, and behavioral patterns of your chosen target audience.

Types of market research interviews:

Market research interviews are categorized in several ways.

By the level of interviewee’s personal involvement:

Face-to-face

The interviewee and the interviewer have a face-to-face appointment in real life. It’s a great method as it enables the researcher to build rapport and analyze the non-verbal cues. The main disadvantages is the budget, the location limitations, and general unwillingness of people to go somewhere to participate in an interview.

Online video conferencing

This method has most of the advantages of a face-to-face appointment. However, it’s cheaper. You’re not limited by geography and your participants are more willing as they do not need to spend their time on the trip to your office and back. Similar to the previous method, it’s perfect for open-ended questions and qualitative research.

Telephone

Telephone interviews are a relatively cheap and fast method. However, the possibilities for building rapport and listening to non-verbal cues are limited. It’s best for close-ended questions.

Form fill-out

The interviewee fills out a questionnaire and submits it to the interviewer. This method requires least time and engagement from the interviewee. It’s the cheapest method. And it’s generally good for quantitative research.

However, there’s no opportunity to build a rapport with the interviewee, and no space for insights. Sometimes this method is categorized as a separate method of market research process.

By the data:

Qualitative - you learn how interviewee feel and what they think (e.g., which services people consider the most important).

Quantitative - you only learn data in numbers (e.g., how many times per week a person uses the application).

Mixed - you learn moth qualitative and quantitative data

By organization:

Structured - all questions are premeditated and close-ended.

Unstructured - questions are open-ended and the interview relies on spontaneity.

Semi-structured - the middle ground between unstructured and structured interviews.

Elevate Your Research Insights with Noty.ai

Make your market research interviews more impactful with Noty.ai. Experience the ease of automated transcriptions and recordings. Don't miss out on valuable information - let Noty.ai be your assistant.

Try meeting transcriptions now!

Pros and cons of market research interviews

Interview as a method of market research has several benefits:

1. It enables you to obtain in-depth information about your target audience, their feelings, ideas, and behaviors.

2. It can give you unexpected insights into your product/service or separate features, especially if you have one-on-one interviews and use semi-structured or unstructured surveys.

3. You can ask the interviewee to test the product/service right on spot.

4. You can observe non-verbal cues if you conduct face-to-face or video interviews.

5. You can build rapport and turn an occasional customer into a loyal one.

The disadvantages of an interview as a method of market research include:

It provides subjective data

The interviews are self-reporting surveys. And we know from psychological research that the results of a self-reporting survey can change with time and is influenced by multiple factors that researchers cannot control.

To mitigate this risk, try to create a neutral environment for your interviewees and build a rapport with them. If you have a team of researchers, try to find the researcher that fits the target group. For example, ask a teammate with children to conduct interviews if you specifically research parents.

The obtained data might not be relevant to your target group

To obtain correct data, the researchers must form the researched group according to certain rules (e.g., have a certain age representation). To provide a statistically correct result you need at least 100 participants.

Obviously, many business researchers are limited in their resources and 100 participants is an unattainable number. It might happen so that most of the research participants turn out to be uncommon to your TA.

For example, you want to research the users of XBox consoles. According to this research, most users are 25-44 years old and do not own Playstation 4. However, the participants of your research are predominantly 44 years-old owners of both competing consoles. As you can see, your group is not representative of your target audience unless you want to find out how to make more owners of Playstation 4 buy your console.

To mitigate this risk, analyze your demographics and come up with different incentives for participation. You should also try to word your request differently for every group.

Interviewer’s bias and interpretation error

Many researchers have their hypotheses and expectations. And sometimes it’s hard to abandon them even if the data proves you’re wrong. When you’re in a position of power, the temptation of breaking rules and tweaking the results is great. To the point when we can do it subconsciously.

This is especially critical for open-ended questions and qualitative research, when the answer is subject to wide interpretation. To minimize the bias we suggest recording and transcribing the interviews. We also suggest asking an opinion of other team members.

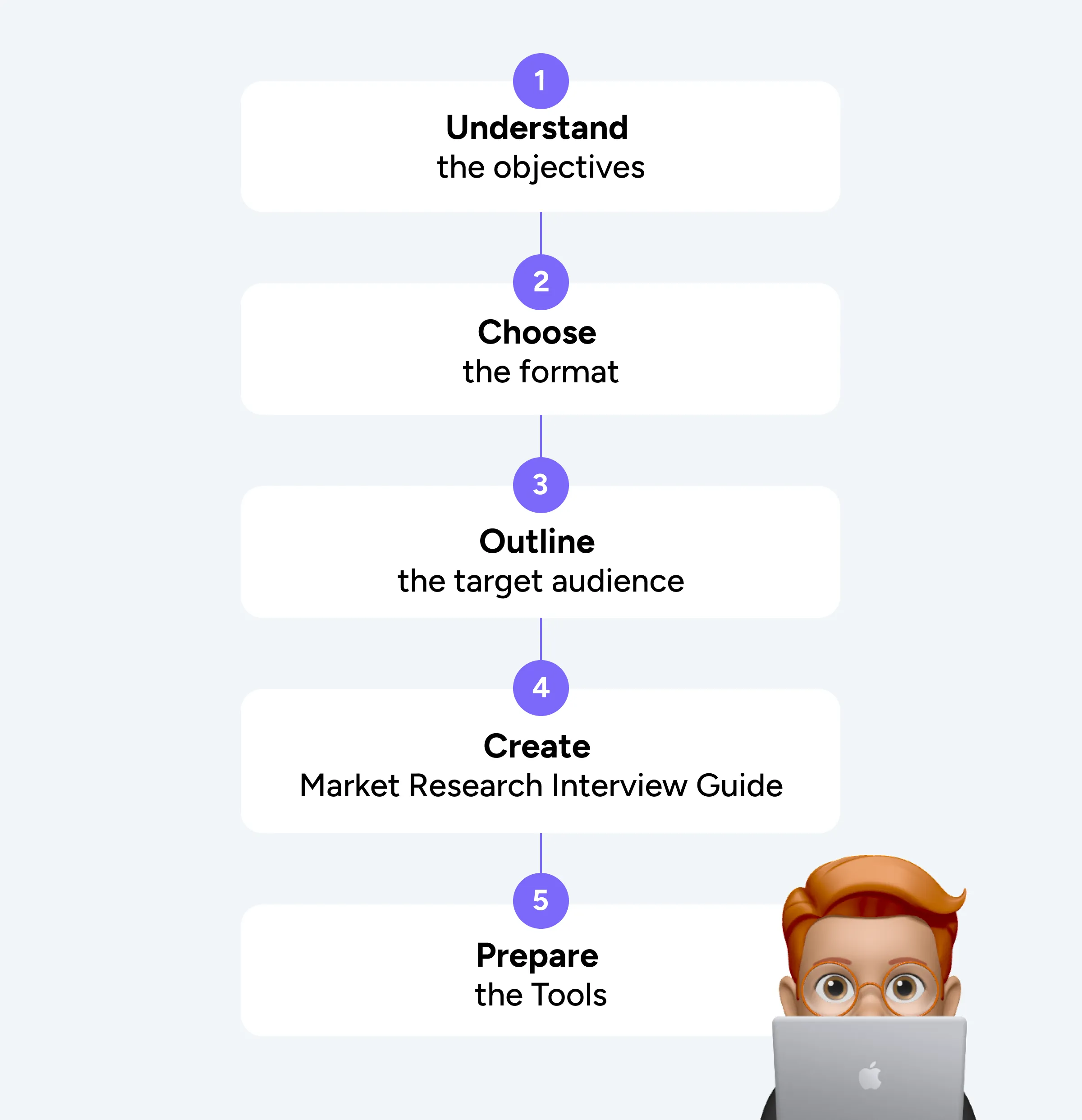

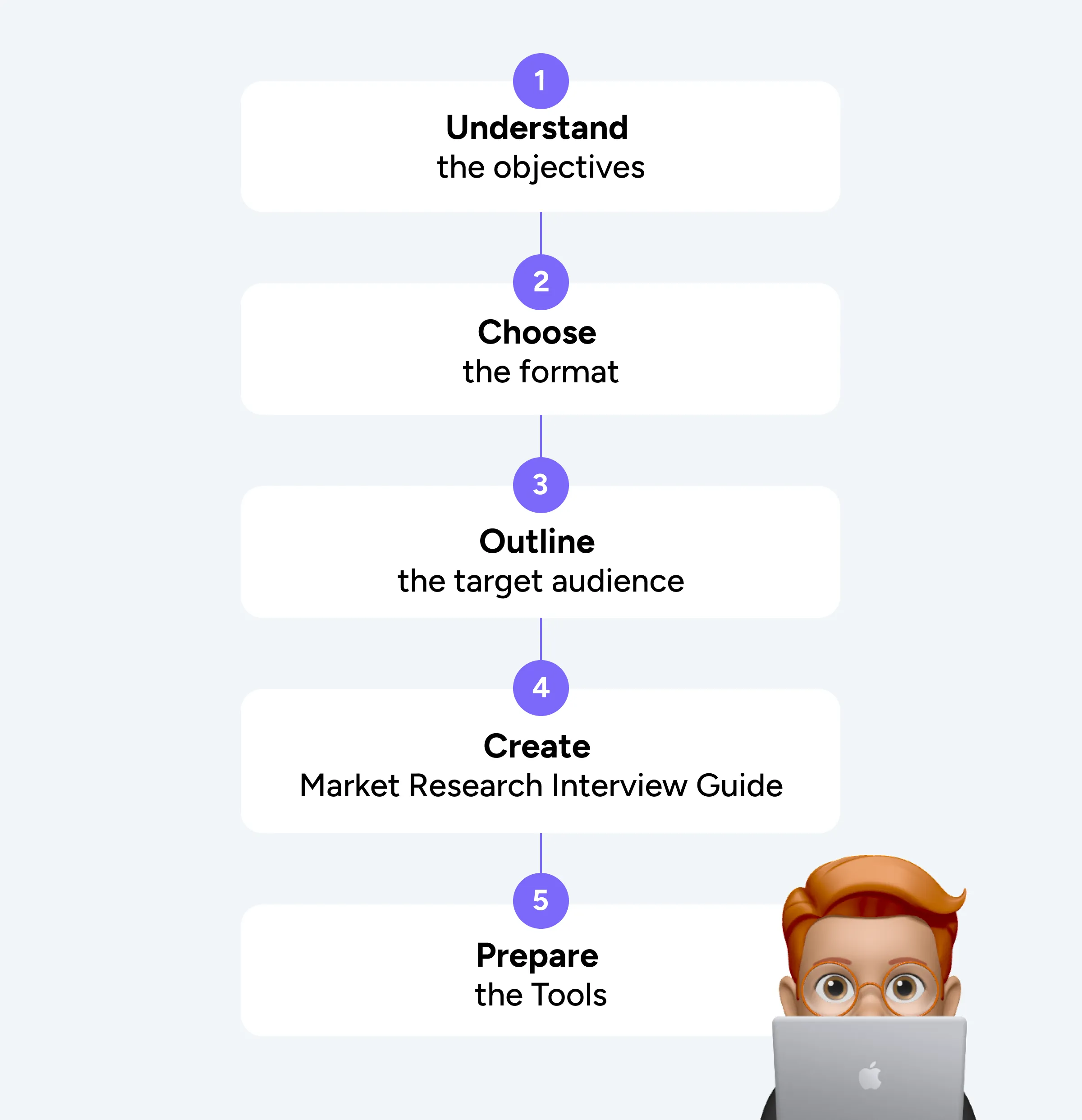

Preparation for the market research interview is a critical step in the market research process.

Identifying the market research objectives

This step will create a solid foundation for your market research interview. You will use it for all the next steps in the process. It will impact the format of the interview, the audience, the guide and the tools you will use.

The objective of the research is the answer to one or several questions about your customers, product, service or brand.

For example, a company is launching a new product. They need to understand how to promote it in their target market. The questions can be: “What are the three criteria for choosing the product?” “What do you use this product for” “What associations do you have with this product?”

Streamline Your Market Analysis with Noty.ai

Dive deeper into your market research interviews with Noty.ai's advanced to-do lists generated from the interview. Get accurate, real-time tasks and uncover hidden insights. Make every interview count.

Embrace the power of to-do lists today!

Choose the format of your market research interview

At this stage you choose the type of interview you want to conduct. Will it be one-on-one meeting in real life or an online call or will a survey be enough? What types of questions do you want to ask, close-ended or open-ended?

The format also will depend on the available budget that you have.

Outline the market research target audience

As mentioned above, the target audience (TA) for your research is critical to get a correct result and correct predictions.

First, identify the demographics of your TA (age, gender, income, geography, etc.). You might have more than one homogeneous group.

Second, identify how many people you can interview. It will depend on the format of interview you chose. The reply rate for the request to participate in marketing research is quite low.

You need to remember that you’ll have to request at least 10 times as many potential participants. Generate a list of potential participants to whom you will send the request. Compile the request message that you will use to ask people to participate in your market research process.

Enhance Interview Accuracy with Noty.ai

Let Noty.ai revolutionize the way you conduct market research interviews. Experience the accuracy and detail of automated transcription and analysis. Capture every nuance and detail effortlessly.

Upgrade to meeting summaries now!

Create Market Research Interview Guide

You know how they say that the best improvisation is the one prepared and rehearsed in advance. You might be a natural communicator. Still it’s best to have a clear plan and understand what to say and when.

That’s why you need a Market Research Interview Guide. Think of it as your playbook for conducting the interview. If you have a truly interesting interlocutor, bright and knowledgeable, the guide will help you not to get carried away and achieve your points. If you have a bad day and your memory plays tricks, it will remind you of the next question. All in all, it’s a must have for a good market researcher.

The Market Research Interview usually consists of four parts:

1. Intro & Warm up

This is the part where you build rapport with your interviewee. Generally, you present yourself, thank them for their time and effort and remind them of the reward. You need to explain shortly how the interview will go. Next, you ask some neutral questions about themselves. This way they will feel valued and seen. The questions will also make them more open up and relax.

2. General Questions

Once you feel that your interviewee feels comfortable and at ease around you, you can start asking questions relative to your market research. Remember these are not the questions that serve your objective.

Examples of general questions are “Do you know the brand ABC?” “Which brands of this product do you know?”

We suggest preparing 10-20 of these questions. It’s not necessary to ask all of them. Usually, you’ll be able to ask up to 6. But sometimes you’ll need more to get a person to talk. These questions can be unique to each of the subgroups that you have.

3. Core Questions

The core questions are the questions that serve the objective of your marketing research. It’s critical to ask all of them to each interviewee. The number of core questions should be limited to up to 5.

4. Wrap Up

It’s important to end the interview on a positive note. Ask them what they think about the topic of the interview. Ask if they have anything else to add to what has already been said. Give them a reward if it is immediately available or explain how the reward will be delivered (ask address or other relative information if necessary).

Thank them for the interview and express hope (e.g., that they will continue to use your product).

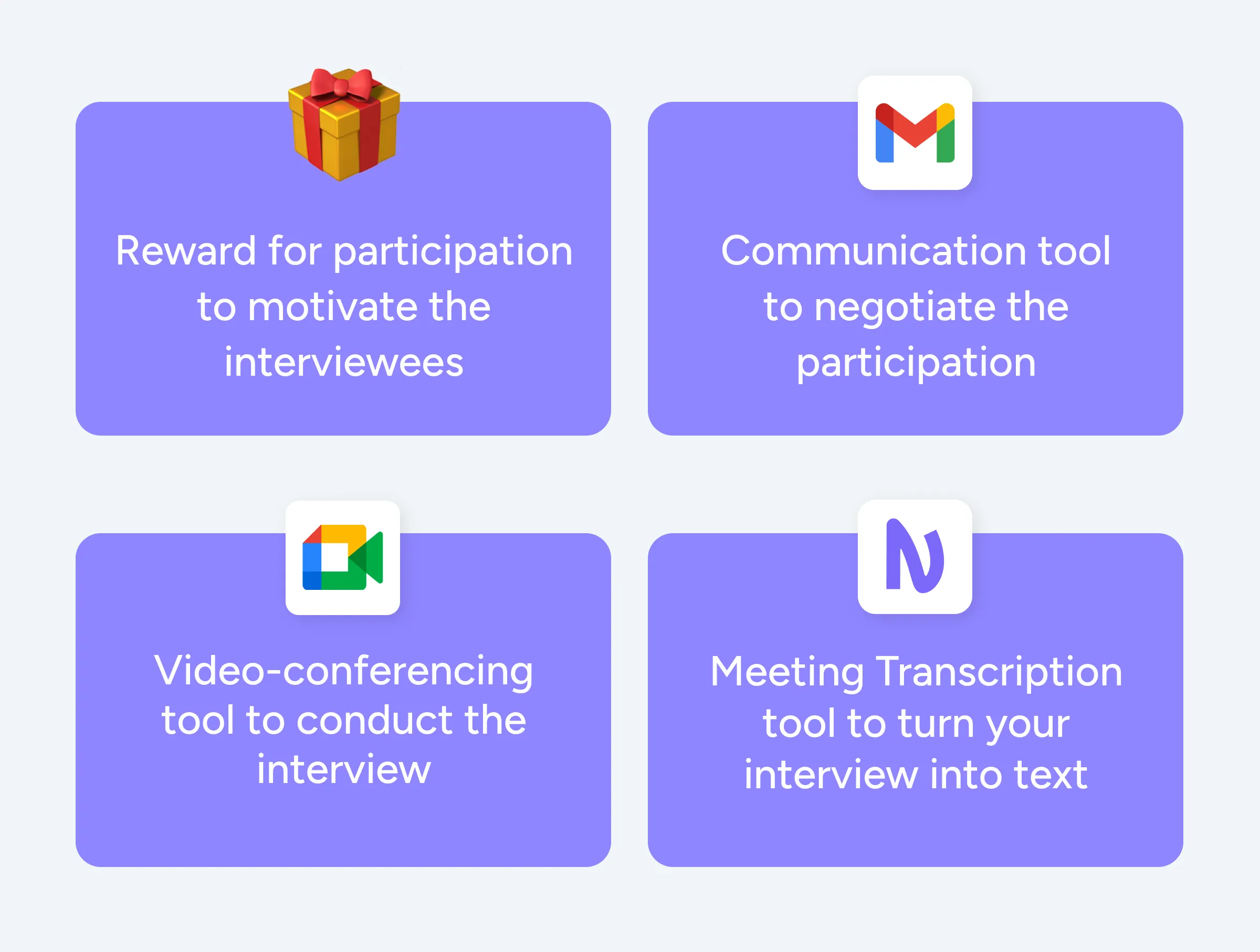

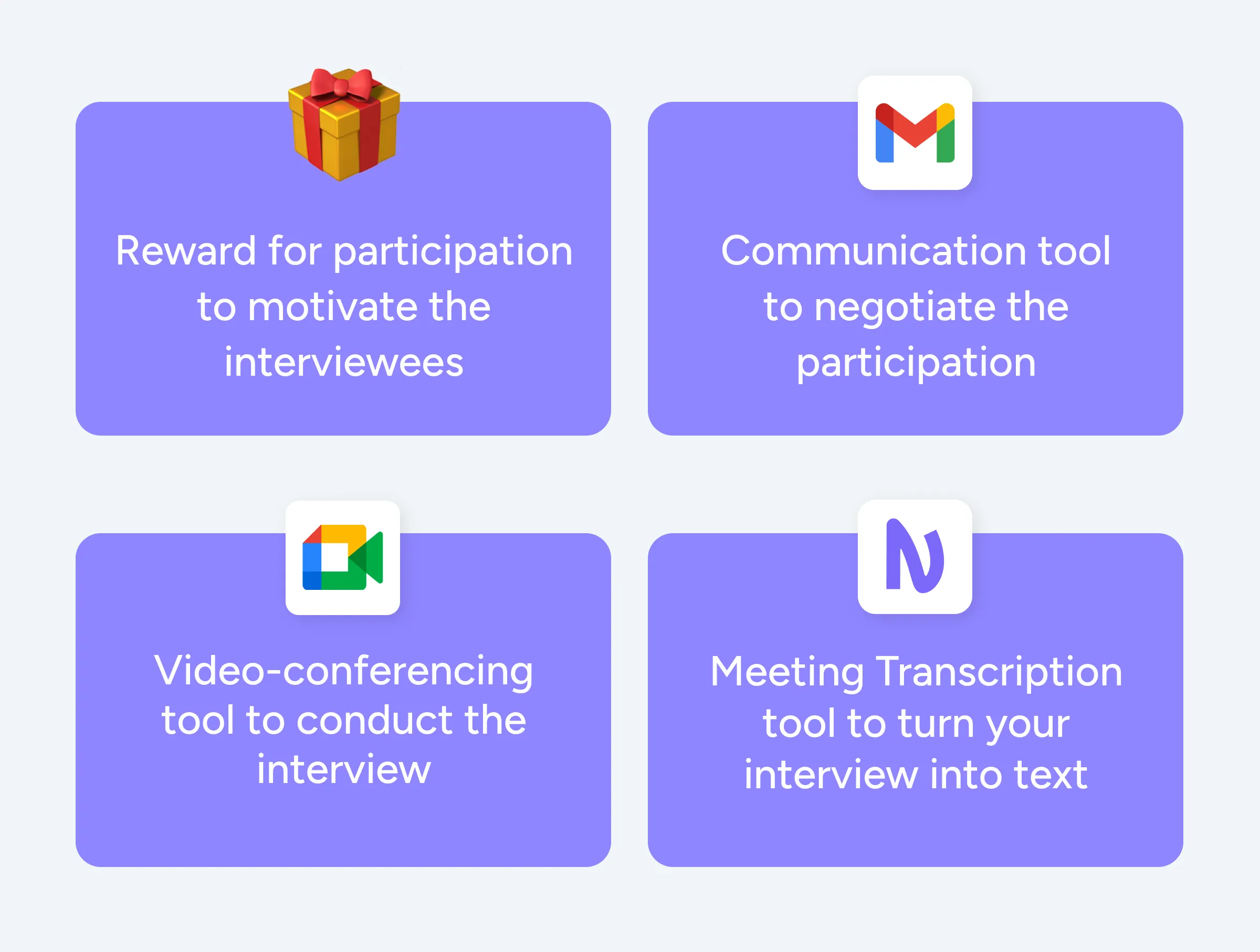

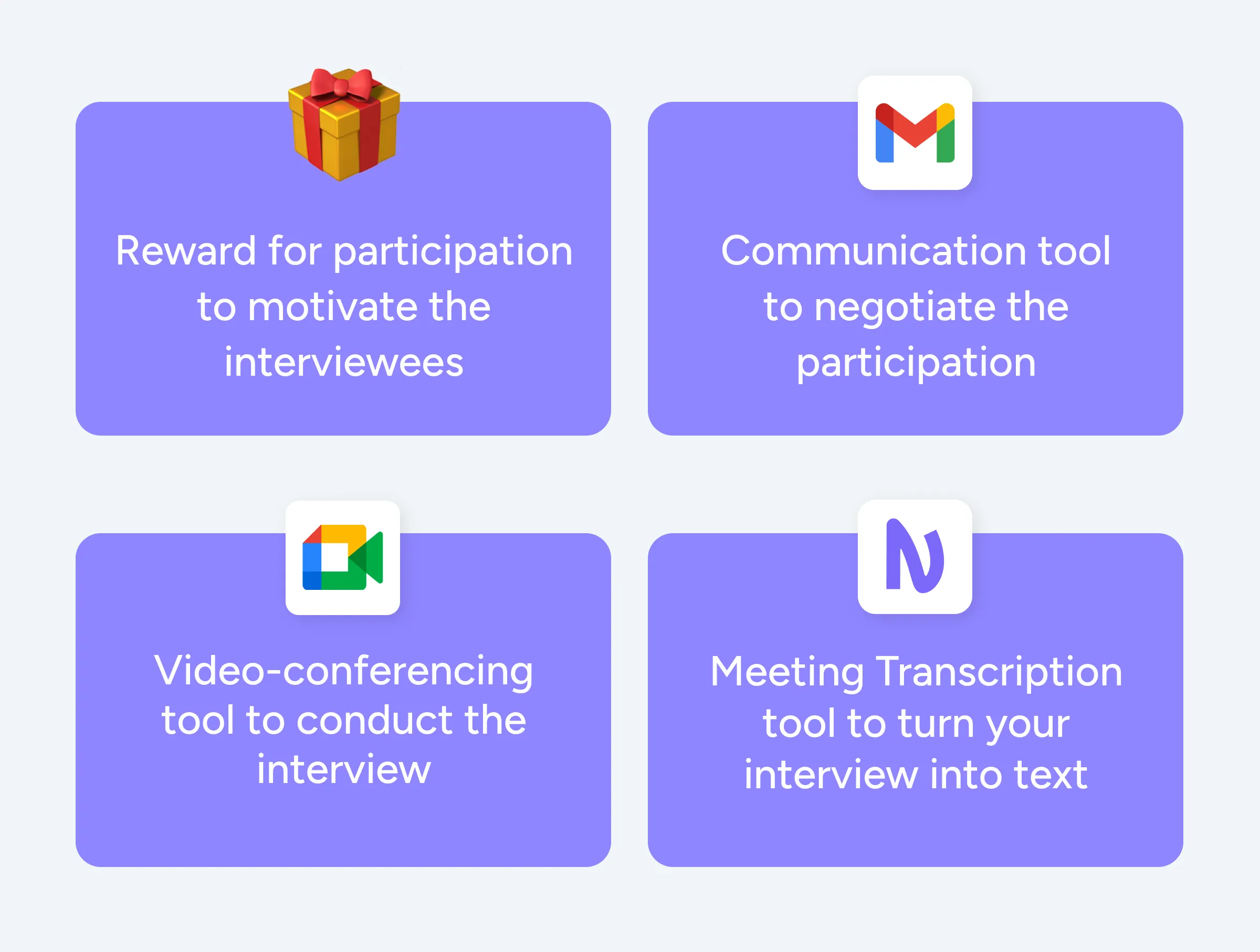

Prepare the Tools

Many market researchers omit this step or do not pay enough attention. In the end, lack of good toolkit can harm your market research overall. Let’s take a quick look at the tools that can help you in your work.

General tools for market research interview

First thing first, the reward for participating in the survey is your major interview tool. Many people would only participate in hope of getting something in return. You need to communicate it clearly. You also need to think about the ways to deliver the reward to the participants.

It is also critical to get management’s approval for the award beforehand. Finally, you need to understand if the award is deliverable at all. This is especially critical for IT companies. Marketers love to come up with ideas on how to lure potential customers with freemium. However, in practice the development team is not able to implement all of their ideas.

Next, you will need the printed-out survey for one-on-one interviews and working pens. You will have to prepare at least two copies per person just in case (e.g., a coffee spills over). Remember that some people tend to take the pens they used for writing with them. They do not do it on purpose. But by the end of the day you might find yourself without a critical tool.

You will also need the online communication solutions, if you conduct a survey online. Most likely it will be email. However, you can also reach out to people via LinkedIn or Facebook, or via messengers.

If you plan a mass send out with a request to participate in your marketing research interview, make sure you use appropriate tools. For example, CRMs will spread out your emails in time so that email providers do not mark them as spam.

If you don’t have or do not want to use a CRM, no worries. In 2023, Gmail launched functionality for mass send outs. It enables you to send the same email to multiple people and they won’t see other senders. Gmail will automatically insert their names in the necessary slots in your email.

Quantitative market research

Quantitative market research requires several additional tools:

1. The online survey form. Most quantitative surveys have closed questions with several answer options to choose from. Tools like Google Forms enable you to automate your survey with drop-down lists, check boxes, etc. It will ease the market research process both for your interviewee (easy fill-out) and for you (easy data gathering).

2. The tool for processing the data. Depending on the research it can be Google Sheets / Excel or more complex SAS.

Qualitative market research

The additional tools for quantitative market research are:

1. Recording device and text-to-speech program for offline interviews. You’ll need a recording device to capture the interview information precisely. Simple note-taking can change the meaning of the original speech. As a result, you might come to the wrong conclusions and it can cost a lot for your company.

The text to speech program will help you transcribe your recorded interview. We suggest using it because text format has multiple advantages over audio recording. First, you can easily find any piece of information you like using the search function or just scanning the text with your eyes. Second, you can copy the key phrases to a separate document or highlight them in the text. And you won’t need to return to the audio recording and listen to them over and over. Third, most people perceive visual information better than audio.

2. Video-conferencing tools for online interviews. When choosing a video-conferencing tool, several aspects need to be considered:

The ability to record the call

The limitations (e.g., 40-minute limit in Zoom free version).

The possibility to add a person who isn’t registered in the application (without the necessity to do it).

3. Meeting transcription tool for online surveys. Tools like Noty integrate with video-conferencing tools and enable you to transcribe your interviews in real time. As a result you get a full transcription of your interview with speakers and time-stamps along with all the benefits of a text over audio recording.

Furthermore, you can pin important parts of your interview and type quick notes right in the Noty widget in Google Meet.

Additionally, they have AI capabilities to summarize the call. You can use custom prompts to get the data you need from the interview in a couple of seconds.

Unleash the Potential of Your Market Research with Noty.ai

Maximize the effectiveness of your market research interviews with Noty.ai. From transcription to analysis, let Noty.ai do the heavy lifting. Discover trends and insights faster and more accurately.

Transform your research process with Noty.ai today!

FAQ

What is the first step in the marketing research process?

The first step in the marketing research process is outlining the subject of your research.

What type of interview is commonly used for market research?

Most common type of interview used for market research is semi-structures, open-end question online interview.

How do I prepare for a market research interview?

You need to understand the key objective of the research, choose the interview format, outline target audience, create the Market Research Interview Guide, and prepare the tools.

What to expect in a market research interview?

You can expect that your hypothesis might be wrong and you need to accept it. You can expect that an interviewee can be interrupted or the conversation will go into the wrong direction. You need to prepare for these scenarios in order to mitigate the risks.

How can I improve my market research skills?

It depends on the skills you need to improve. Market research process requires strong analytical and strong communication skills as well as a profound knowledge of data analysis tools. Not all people have both. One of the great ways to boost your communication skills is to take theater classes. They teach you how to read non-verbal cues, how to interact with a partner as one, and how to control your body language, facial expressions, and voice. Analytical skills can be boosted through solving logic puzzles and mathematical problems. You can also take courses in marketing analysis. Finally, to get a good grip of data analysis tools you can either take online courses or use YouTube videos.

What are the main questions in a market research interview?

There are three types of questions you will need to ask during the market research interview. Start with icebreaker questions that will help you establish your rapport with the interviewee. Next, ask general questions related to the market, their experience with brands and products, etc. Finally, ask the core questions related to the market research objectives.

Customers are a valuable source of knowledge for any marketer. To learn what they think, how they feel, and how they behave, we can use Market Research Interviews. This tool of market research can help you collect valuable quantitative or qualitative information about your potential or existing customers.

Market research interviews are helpful for making right marketing decisions on expanding to new markets, launching new products, or changing the way a product or service is promoted.

Marketing research process identifies a set of practices used by a company to study its target market.

Market research process can help you with the following activities:

Study your competitors

Understand your current customers

Identify and study potential customers

Learn about new niches or markets

Keeping up with trends

Developing and introducing new products/services

Rebranding & changing marketing strategies

Altering the existing products/services

Creating or changing your positioning

Transform Your Market Research with Noty.ai

Discover the next level of efficiency in your market research interviews. Utilize Noty.ai to capture and analyze insights like never before. Say goodbye to manual note-taking and hello to enhanced productivity.

Start using Noty.ai AI meeting notes today!

Types of Market Research

Primary market research

A business studies market, its trends, and TA, using surveys, interviews, etc. It requires a large budget, time and dedicated specialists.

Secondary market research

A business uses existing market research (from several sources) to compile one document. It is usually conducted when the budget for research is tight.

Methods of market research

Interviews

Surveys

Roundtables

Focus Groups

Observation

Reporting

Goals of marketing research process

Make marketing decisions, like launching a new product, targeting a new market, etc.

Identify new opportunities for business

Provide information for potential investors

Mitigate business risks and avoid mistakes

Benefits of marketing research process

Data-driven marketing

Better understanding of your competitors, products, and TA.

The ability to cater your marketing activities to meet the customer needs.

Better planning and ability to improve ROI of marketing activities.

Steps in marketing research process

Outline the subject you’re going to research. For example, we need to study the features that the competing tools provide.

Develop the playbook for your research. It will contain the subject of research and the type of data you need to gather, the methods (e.g., interview), the necessary resources (time, budget), the timeline, and the step-by-step plan.

Approve the plan with top management and allocate the necessary resources.

Implement the research plan and gather the data.

Analyze the data and develop your recommendations for the business.

Present the marketing research to the management.

Market research interview is one of the tools of market research that enables you to learn the feelings, opinions, and behavioral patterns of your chosen target audience.

Types of market research interviews:

Market research interviews are categorized in several ways.

By the level of interviewee’s personal involvement:

Face-to-face

The interviewee and the interviewer have a face-to-face appointment in real life. It’s a great method as it enables the researcher to build rapport and analyze the non-verbal cues. The main disadvantages is the budget, the location limitations, and general unwillingness of people to go somewhere to participate in an interview.

Online video conferencing

This method has most of the advantages of a face-to-face appointment. However, it’s cheaper. You’re not limited by geography and your participants are more willing as they do not need to spend their time on the trip to your office and back. Similar to the previous method, it’s perfect for open-ended questions and qualitative research.

Telephone

Telephone interviews are a relatively cheap and fast method. However, the possibilities for building rapport and listening to non-verbal cues are limited. It’s best for close-ended questions.

Form fill-out

The interviewee fills out a questionnaire and submits it to the interviewer. This method requires least time and engagement from the interviewee. It’s the cheapest method. And it’s generally good for quantitative research.

However, there’s no opportunity to build a rapport with the interviewee, and no space for insights. Sometimes this method is categorized as a separate method of market research process.

By the data:

Qualitative - you learn how interviewee feel and what they think (e.g., which services people consider the most important).

Quantitative - you only learn data in numbers (e.g., how many times per week a person uses the application).

Mixed - you learn moth qualitative and quantitative data

By organization:

Structured - all questions are premeditated and close-ended.

Unstructured - questions are open-ended and the interview relies on spontaneity.

Semi-structured - the middle ground between unstructured and structured interviews.

Elevate Your Research Insights with Noty.ai

Make your market research interviews more impactful with Noty.ai. Experience the ease of automated transcriptions and recordings. Don't miss out on valuable information - let Noty.ai be your assistant.

Try meeting transcriptions now!

Pros and cons of market research interviews

Interview as a method of market research has several benefits:

1. It enables you to obtain in-depth information about your target audience, their feelings, ideas, and behaviors.

2. It can give you unexpected insights into your product/service or separate features, especially if you have one-on-one interviews and use semi-structured or unstructured surveys.

3. You can ask the interviewee to test the product/service right on spot.

4. You can observe non-verbal cues if you conduct face-to-face or video interviews.

5. You can build rapport and turn an occasional customer into a loyal one.

The disadvantages of an interview as a method of market research include:

It provides subjective data

The interviews are self-reporting surveys. And we know from psychological research that the results of a self-reporting survey can change with time and is influenced by multiple factors that researchers cannot control.

To mitigate this risk, try to create a neutral environment for your interviewees and build a rapport with them. If you have a team of researchers, try to find the researcher that fits the target group. For example, ask a teammate with children to conduct interviews if you specifically research parents.

The obtained data might not be relevant to your target group

To obtain correct data, the researchers must form the researched group according to certain rules (e.g., have a certain age representation). To provide a statistically correct result you need at least 100 participants.

Obviously, many business researchers are limited in their resources and 100 participants is an unattainable number. It might happen so that most of the research participants turn out to be uncommon to your TA.

For example, you want to research the users of XBox consoles. According to this research, most users are 25-44 years old and do not own Playstation 4. However, the participants of your research are predominantly 44 years-old owners of both competing consoles. As you can see, your group is not representative of your target audience unless you want to find out how to make more owners of Playstation 4 buy your console.

To mitigate this risk, analyze your demographics and come up with different incentives for participation. You should also try to word your request differently for every group.

Interviewer’s bias and interpretation error

Many researchers have their hypotheses and expectations. And sometimes it’s hard to abandon them even if the data proves you’re wrong. When you’re in a position of power, the temptation of breaking rules and tweaking the results is great. To the point when we can do it subconsciously.

This is especially critical for open-ended questions and qualitative research, when the answer is subject to wide interpretation. To minimize the bias we suggest recording and transcribing the interviews. We also suggest asking an opinion of other team members.

Preparation for the market research interview is a critical step in the market research process.

Identifying the market research objectives

This step will create a solid foundation for your market research interview. You will use it for all the next steps in the process. It will impact the format of the interview, the audience, the guide and the tools you will use.

The objective of the research is the answer to one or several questions about your customers, product, service or brand.

For example, a company is launching a new product. They need to understand how to promote it in their target market. The questions can be: “What are the three criteria for choosing the product?” “What do you use this product for” “What associations do you have with this product?”

Streamline Your Market Analysis with Noty.ai

Dive deeper into your market research interviews with Noty.ai's advanced to-do lists generated from the interview. Get accurate, real-time tasks and uncover hidden insights. Make every interview count.

Embrace the power of to-do lists today!

Choose the format of your market research interview

At this stage you choose the type of interview you want to conduct. Will it be one-on-one meeting in real life or an online call or will a survey be enough? What types of questions do you want to ask, close-ended or open-ended?

The format also will depend on the available budget that you have.

Outline the market research target audience

As mentioned above, the target audience (TA) for your research is critical to get a correct result and correct predictions.

First, identify the demographics of your TA (age, gender, income, geography, etc.). You might have more than one homogeneous group.

Second, identify how many people you can interview. It will depend on the format of interview you chose. The reply rate for the request to participate in marketing research is quite low.

You need to remember that you’ll have to request at least 10 times as many potential participants. Generate a list of potential participants to whom you will send the request. Compile the request message that you will use to ask people to participate in your market research process.

Enhance Interview Accuracy with Noty.ai

Let Noty.ai revolutionize the way you conduct market research interviews. Experience the accuracy and detail of automated transcription and analysis. Capture every nuance and detail effortlessly.

Upgrade to meeting summaries now!

Create Market Research Interview Guide

You know how they say that the best improvisation is the one prepared and rehearsed in advance. You might be a natural communicator. Still it’s best to have a clear plan and understand what to say and when.

That’s why you need a Market Research Interview Guide. Think of it as your playbook for conducting the interview. If you have a truly interesting interlocutor, bright and knowledgeable, the guide will help you not to get carried away and achieve your points. If you have a bad day and your memory plays tricks, it will remind you of the next question. All in all, it’s a must have for a good market researcher.

The Market Research Interview usually consists of four parts:

1. Intro & Warm up

This is the part where you build rapport with your interviewee. Generally, you present yourself, thank them for their time and effort and remind them of the reward. You need to explain shortly how the interview will go. Next, you ask some neutral questions about themselves. This way they will feel valued and seen. The questions will also make them more open up and relax.

2. General Questions

Once you feel that your interviewee feels comfortable and at ease around you, you can start asking questions relative to your market research. Remember these are not the questions that serve your objective.

Examples of general questions are “Do you know the brand ABC?” “Which brands of this product do you know?”

We suggest preparing 10-20 of these questions. It’s not necessary to ask all of them. Usually, you’ll be able to ask up to 6. But sometimes you’ll need more to get a person to talk. These questions can be unique to each of the subgroups that you have.

3. Core Questions

The core questions are the questions that serve the objective of your marketing research. It’s critical to ask all of them to each interviewee. The number of core questions should be limited to up to 5.

4. Wrap Up

It’s important to end the interview on a positive note. Ask them what they think about the topic of the interview. Ask if they have anything else to add to what has already been said. Give them a reward if it is immediately available or explain how the reward will be delivered (ask address or other relative information if necessary).

Thank them for the interview and express hope (e.g., that they will continue to use your product).

Prepare the Tools

Many market researchers omit this step or do not pay enough attention. In the end, lack of good toolkit can harm your market research overall. Let’s take a quick look at the tools that can help you in your work.

General tools for market research interview

First thing first, the reward for participating in the survey is your major interview tool. Many people would only participate in hope of getting something in return. You need to communicate it clearly. You also need to think about the ways to deliver the reward to the participants.

It is also critical to get management’s approval for the award beforehand. Finally, you need to understand if the award is deliverable at all. This is especially critical for IT companies. Marketers love to come up with ideas on how to lure potential customers with freemium. However, in practice the development team is not able to implement all of their ideas.

Next, you will need the printed-out survey for one-on-one interviews and working pens. You will have to prepare at least two copies per person just in case (e.g., a coffee spills over). Remember that some people tend to take the pens they used for writing with them. They do not do it on purpose. But by the end of the day you might find yourself without a critical tool.

You will also need the online communication solutions, if you conduct a survey online. Most likely it will be email. However, you can also reach out to people via LinkedIn or Facebook, or via messengers.

If you plan a mass send out with a request to participate in your marketing research interview, make sure you use appropriate tools. For example, CRMs will spread out your emails in time so that email providers do not mark them as spam.

If you don’t have or do not want to use a CRM, no worries. In 2023, Gmail launched functionality for mass send outs. It enables you to send the same email to multiple people and they won’t see other senders. Gmail will automatically insert their names in the necessary slots in your email.

Quantitative market research

Quantitative market research requires several additional tools:

1. The online survey form. Most quantitative surveys have closed questions with several answer options to choose from. Tools like Google Forms enable you to automate your survey with drop-down lists, check boxes, etc. It will ease the market research process both for your interviewee (easy fill-out) and for you (easy data gathering).

2. The tool for processing the data. Depending on the research it can be Google Sheets / Excel or more complex SAS.

Qualitative market research

The additional tools for quantitative market research are:

1. Recording device and text-to-speech program for offline interviews. You’ll need a recording device to capture the interview information precisely. Simple note-taking can change the meaning of the original speech. As a result, you might come to the wrong conclusions and it can cost a lot for your company.

The text to speech program will help you transcribe your recorded interview. We suggest using it because text format has multiple advantages over audio recording. First, you can easily find any piece of information you like using the search function or just scanning the text with your eyes. Second, you can copy the key phrases to a separate document or highlight them in the text. And you won’t need to return to the audio recording and listen to them over and over. Third, most people perceive visual information better than audio.

2. Video-conferencing tools for online interviews. When choosing a video-conferencing tool, several aspects need to be considered:

The ability to record the call

The limitations (e.g., 40-minute limit in Zoom free version).

The possibility to add a person who isn’t registered in the application (without the necessity to do it).

3. Meeting transcription tool for online surveys. Tools like Noty integrate with video-conferencing tools and enable you to transcribe your interviews in real time. As a result you get a full transcription of your interview with speakers and time-stamps along with all the benefits of a text over audio recording.

Furthermore, you can pin important parts of your interview and type quick notes right in the Noty widget in Google Meet.

Additionally, they have AI capabilities to summarize the call. You can use custom prompts to get the data you need from the interview in a couple of seconds.

Unleash the Potential of Your Market Research with Noty.ai

Maximize the effectiveness of your market research interviews with Noty.ai. From transcription to analysis, let Noty.ai do the heavy lifting. Discover trends and insights faster and more accurately.

Transform your research process with Noty.ai today!

FAQ

What is the first step in the marketing research process?

The first step in the marketing research process is outlining the subject of your research.

What type of interview is commonly used for market research?

Most common type of interview used for market research is semi-structures, open-end question online interview.

How do I prepare for a market research interview?

You need to understand the key objective of the research, choose the interview format, outline target audience, create the Market Research Interview Guide, and prepare the tools.

What to expect in a market research interview?

You can expect that your hypothesis might be wrong and you need to accept it. You can expect that an interviewee can be interrupted or the conversation will go into the wrong direction. You need to prepare for these scenarios in order to mitigate the risks.

How can I improve my market research skills?

It depends on the skills you need to improve. Market research process requires strong analytical and strong communication skills as well as a profound knowledge of data analysis tools. Not all people have both. One of the great ways to boost your communication skills is to take theater classes. They teach you how to read non-verbal cues, how to interact with a partner as one, and how to control your body language, facial expressions, and voice. Analytical skills can be boosted through solving logic puzzles and mathematical problems. You can also take courses in marketing analysis. Finally, to get a good grip of data analysis tools you can either take online courses or use YouTube videos.

What are the main questions in a market research interview?

There are three types of questions you will need to ask during the market research interview. Start with icebreaker questions that will help you establish your rapport with the interviewee. Next, ask general questions related to the market, their experience with brands and products, etc. Finally, ask the core questions related to the market research objectives.

Customers are a valuable source of knowledge for any marketer. To learn what they think, how they feel, and how they behave, we can use Market Research Interviews. This tool of market research can help you collect valuable quantitative or qualitative information about your potential or existing customers.

Market research interviews are helpful for making right marketing decisions on expanding to new markets, launching new products, or changing the way a product or service is promoted.

Marketing research process identifies a set of practices used by a company to study its target market.

Market research process can help you with the following activities:

Study your competitors

Understand your current customers

Identify and study potential customers

Learn about new niches or markets

Keeping up with trends

Developing and introducing new products/services

Rebranding & changing marketing strategies

Altering the existing products/services

Creating or changing your positioning

Transform Your Market Research with Noty.ai

Discover the next level of efficiency in your market research interviews. Utilize Noty.ai to capture and analyze insights like never before. Say goodbye to manual note-taking and hello to enhanced productivity.

Start using Noty.ai AI meeting notes today!

Types of Market Research

Primary market research

A business studies market, its trends, and TA, using surveys, interviews, etc. It requires a large budget, time and dedicated specialists.

Secondary market research

A business uses existing market research (from several sources) to compile one document. It is usually conducted when the budget for research is tight.

Methods of market research

Interviews

Surveys

Roundtables

Focus Groups

Observation

Reporting

Goals of marketing research process

Make marketing decisions, like launching a new product, targeting a new market, etc.

Identify new opportunities for business

Provide information for potential investors

Mitigate business risks and avoid mistakes

Benefits of marketing research process

Data-driven marketing

Better understanding of your competitors, products, and TA.

The ability to cater your marketing activities to meet the customer needs.

Better planning and ability to improve ROI of marketing activities.

Steps in marketing research process

Outline the subject you’re going to research. For example, we need to study the features that the competing tools provide.

Develop the playbook for your research. It will contain the subject of research and the type of data you need to gather, the methods (e.g., interview), the necessary resources (time, budget), the timeline, and the step-by-step plan.

Approve the plan with top management and allocate the necessary resources.

Implement the research plan and gather the data.

Analyze the data and develop your recommendations for the business.

Present the marketing research to the management.

Market research interview is one of the tools of market research that enables you to learn the feelings, opinions, and behavioral patterns of your chosen target audience.

Types of market research interviews:

Market research interviews are categorized in several ways.

By the level of interviewee’s personal involvement:

Face-to-face

The interviewee and the interviewer have a face-to-face appointment in real life. It’s a great method as it enables the researcher to build rapport and analyze the non-verbal cues. The main disadvantages is the budget, the location limitations, and general unwillingness of people to go somewhere to participate in an interview.

Online video conferencing

This method has most of the advantages of a face-to-face appointment. However, it’s cheaper. You’re not limited by geography and your participants are more willing as they do not need to spend their time on the trip to your office and back. Similar to the previous method, it’s perfect for open-ended questions and qualitative research.

Telephone

Telephone interviews are a relatively cheap and fast method. However, the possibilities for building rapport and listening to non-verbal cues are limited. It’s best for close-ended questions.

Form fill-out

The interviewee fills out a questionnaire and submits it to the interviewer. This method requires least time and engagement from the interviewee. It’s the cheapest method. And it’s generally good for quantitative research.

However, there’s no opportunity to build a rapport with the interviewee, and no space for insights. Sometimes this method is categorized as a separate method of market research process.

By the data:

Qualitative - you learn how interviewee feel and what they think (e.g., which services people consider the most important).

Quantitative - you only learn data in numbers (e.g., how many times per week a person uses the application).

Mixed - you learn moth qualitative and quantitative data

By organization:

Structured - all questions are premeditated and close-ended.

Unstructured - questions are open-ended and the interview relies on spontaneity.

Semi-structured - the middle ground between unstructured and structured interviews.

Elevate Your Research Insights with Noty.ai

Make your market research interviews more impactful with Noty.ai. Experience the ease of automated transcriptions and recordings. Don't miss out on valuable information - let Noty.ai be your assistant.

Try meeting transcriptions now!

Pros and cons of market research interviews

Interview as a method of market research has several benefits:

1. It enables you to obtain in-depth information about your target audience, their feelings, ideas, and behaviors.

2. It can give you unexpected insights into your product/service or separate features, especially if you have one-on-one interviews and use semi-structured or unstructured surveys.

3. You can ask the interviewee to test the product/service right on spot.

4. You can observe non-verbal cues if you conduct face-to-face or video interviews.

5. You can build rapport and turn an occasional customer into a loyal one.

The disadvantages of an interview as a method of market research include:

It provides subjective data

The interviews are self-reporting surveys. And we know from psychological research that the results of a self-reporting survey can change with time and is influenced by multiple factors that researchers cannot control.

To mitigate this risk, try to create a neutral environment for your interviewees and build a rapport with them. If you have a team of researchers, try to find the researcher that fits the target group. For example, ask a teammate with children to conduct interviews if you specifically research parents.

The obtained data might not be relevant to your target group

To obtain correct data, the researchers must form the researched group according to certain rules (e.g., have a certain age representation). To provide a statistically correct result you need at least 100 participants.

Obviously, many business researchers are limited in their resources and 100 participants is an unattainable number. It might happen so that most of the research participants turn out to be uncommon to your TA.

For example, you want to research the users of XBox consoles. According to this research, most users are 25-44 years old and do not own Playstation 4. However, the participants of your research are predominantly 44 years-old owners of both competing consoles. As you can see, your group is not representative of your target audience unless you want to find out how to make more owners of Playstation 4 buy your console.

To mitigate this risk, analyze your demographics and come up with different incentives for participation. You should also try to word your request differently for every group.

Interviewer’s bias and interpretation error

Many researchers have their hypotheses and expectations. And sometimes it’s hard to abandon them even if the data proves you’re wrong. When you’re in a position of power, the temptation of breaking rules and tweaking the results is great. To the point when we can do it subconsciously.

This is especially critical for open-ended questions and qualitative research, when the answer is subject to wide interpretation. To minimize the bias we suggest recording and transcribing the interviews. We also suggest asking an opinion of other team members.

Preparation for the market research interview is a critical step in the market research process.

Identifying the market research objectives

This step will create a solid foundation for your market research interview. You will use it for all the next steps in the process. It will impact the format of the interview, the audience, the guide and the tools you will use.

The objective of the research is the answer to one or several questions about your customers, product, service or brand.

For example, a company is launching a new product. They need to understand how to promote it in their target market. The questions can be: “What are the three criteria for choosing the product?” “What do you use this product for” “What associations do you have with this product?”

Streamline Your Market Analysis with Noty.ai

Dive deeper into your market research interviews with Noty.ai's advanced to-do lists generated from the interview. Get accurate, real-time tasks and uncover hidden insights. Make every interview count.

Embrace the power of to-do lists today!

Choose the format of your market research interview

At this stage you choose the type of interview you want to conduct. Will it be one-on-one meeting in real life or an online call or will a survey be enough? What types of questions do you want to ask, close-ended or open-ended?

The format also will depend on the available budget that you have.

Outline the market research target audience

As mentioned above, the target audience (TA) for your research is critical to get a correct result and correct predictions.

First, identify the demographics of your TA (age, gender, income, geography, etc.). You might have more than one homogeneous group.

Second, identify how many people you can interview. It will depend on the format of interview you chose. The reply rate for the request to participate in marketing research is quite low.

You need to remember that you’ll have to request at least 10 times as many potential participants. Generate a list of potential participants to whom you will send the request. Compile the request message that you will use to ask people to participate in your market research process.

Enhance Interview Accuracy with Noty.ai

Let Noty.ai revolutionize the way you conduct market research interviews. Experience the accuracy and detail of automated transcription and analysis. Capture every nuance and detail effortlessly.

Upgrade to meeting summaries now!

Create Market Research Interview Guide

You know how they say that the best improvisation is the one prepared and rehearsed in advance. You might be a natural communicator. Still it’s best to have a clear plan and understand what to say and when.

That’s why you need a Market Research Interview Guide. Think of it as your playbook for conducting the interview. If you have a truly interesting interlocutor, bright and knowledgeable, the guide will help you not to get carried away and achieve your points. If you have a bad day and your memory plays tricks, it will remind you of the next question. All in all, it’s a must have for a good market researcher.

The Market Research Interview usually consists of four parts:

1. Intro & Warm up

This is the part where you build rapport with your interviewee. Generally, you present yourself, thank them for their time and effort and remind them of the reward. You need to explain shortly how the interview will go. Next, you ask some neutral questions about themselves. This way they will feel valued and seen. The questions will also make them more open up and relax.

2. General Questions

Once you feel that your interviewee feels comfortable and at ease around you, you can start asking questions relative to your market research. Remember these are not the questions that serve your objective.

Examples of general questions are “Do you know the brand ABC?” “Which brands of this product do you know?”

We suggest preparing 10-20 of these questions. It’s not necessary to ask all of them. Usually, you’ll be able to ask up to 6. But sometimes you’ll need more to get a person to talk. These questions can be unique to each of the subgroups that you have.

3. Core Questions

The core questions are the questions that serve the objective of your marketing research. It’s critical to ask all of them to each interviewee. The number of core questions should be limited to up to 5.

4. Wrap Up

It’s important to end the interview on a positive note. Ask them what they think about the topic of the interview. Ask if they have anything else to add to what has already been said. Give them a reward if it is immediately available or explain how the reward will be delivered (ask address or other relative information if necessary).

Thank them for the interview and express hope (e.g., that they will continue to use your product).

Prepare the Tools

Many market researchers omit this step or do not pay enough attention. In the end, lack of good toolkit can harm your market research overall. Let’s take a quick look at the tools that can help you in your work.

General tools for market research interview

First thing first, the reward for participating in the survey is your major interview tool. Many people would only participate in hope of getting something in return. You need to communicate it clearly. You also need to think about the ways to deliver the reward to the participants.

It is also critical to get management’s approval for the award beforehand. Finally, you need to understand if the award is deliverable at all. This is especially critical for IT companies. Marketers love to come up with ideas on how to lure potential customers with freemium. However, in practice the development team is not able to implement all of their ideas.

Next, you will need the printed-out survey for one-on-one interviews and working pens. You will have to prepare at least two copies per person just in case (e.g., a coffee spills over). Remember that some people tend to take the pens they used for writing with them. They do not do it on purpose. But by the end of the day you might find yourself without a critical tool.

You will also need the online communication solutions, if you conduct a survey online. Most likely it will be email. However, you can also reach out to people via LinkedIn or Facebook, or via messengers.

If you plan a mass send out with a request to participate in your marketing research interview, make sure you use appropriate tools. For example, CRMs will spread out your emails in time so that email providers do not mark them as spam.

If you don’t have or do not want to use a CRM, no worries. In 2023, Gmail launched functionality for mass send outs. It enables you to send the same email to multiple people and they won’t see other senders. Gmail will automatically insert their names in the necessary slots in your email.

Quantitative market research

Quantitative market research requires several additional tools:

1. The online survey form. Most quantitative surveys have closed questions with several answer options to choose from. Tools like Google Forms enable you to automate your survey with drop-down lists, check boxes, etc. It will ease the market research process both for your interviewee (easy fill-out) and for you (easy data gathering).

2. The tool for processing the data. Depending on the research it can be Google Sheets / Excel or more complex SAS.

Qualitative market research

The additional tools for quantitative market research are:

1. Recording device and text-to-speech program for offline interviews. You’ll need a recording device to capture the interview information precisely. Simple note-taking can change the meaning of the original speech. As a result, you might come to the wrong conclusions and it can cost a lot for your company.

The text to speech program will help you transcribe your recorded interview. We suggest using it because text format has multiple advantages over audio recording. First, you can easily find any piece of information you like using the search function or just scanning the text with your eyes. Second, you can copy the key phrases to a separate document or highlight them in the text. And you won’t need to return to the audio recording and listen to them over and over. Third, most people perceive visual information better than audio.

2. Video-conferencing tools for online interviews. When choosing a video-conferencing tool, several aspects need to be considered:

The ability to record the call

The limitations (e.g., 40-minute limit in Zoom free version).

The possibility to add a person who isn’t registered in the application (without the necessity to do it).

3. Meeting transcription tool for online surveys. Tools like Noty integrate with video-conferencing tools and enable you to transcribe your interviews in real time. As a result you get a full transcription of your interview with speakers and time-stamps along with all the benefits of a text over audio recording.

Furthermore, you can pin important parts of your interview and type quick notes right in the Noty widget in Google Meet.

Additionally, they have AI capabilities to summarize the call. You can use custom prompts to get the data you need from the interview in a couple of seconds.

Unleash the Potential of Your Market Research with Noty.ai

Maximize the effectiveness of your market research interviews with Noty.ai. From transcription to analysis, let Noty.ai do the heavy lifting. Discover trends and insights faster and more accurately.

Transform your research process with Noty.ai today!

FAQ

What is the first step in the marketing research process?

The first step in the marketing research process is outlining the subject of your research.

What type of interview is commonly used for market research?

Most common type of interview used for market research is semi-structures, open-end question online interview.

How do I prepare for a market research interview?

You need to understand the key objective of the research, choose the interview format, outline target audience, create the Market Research Interview Guide, and prepare the tools.

What to expect in a market research interview?

You can expect that your hypothesis might be wrong and you need to accept it. You can expect that an interviewee can be interrupted or the conversation will go into the wrong direction. You need to prepare for these scenarios in order to mitigate the risks.

How can I improve my market research skills?

It depends on the skills you need to improve. Market research process requires strong analytical and strong communication skills as well as a profound knowledge of data analysis tools. Not all people have both. One of the great ways to boost your communication skills is to take theater classes. They teach you how to read non-verbal cues, how to interact with a partner as one, and how to control your body language, facial expressions, and voice. Analytical skills can be boosted through solving logic puzzles and mathematical problems. You can also take courses in marketing analysis. Finally, to get a good grip of data analysis tools you can either take online courses or use YouTube videos.

What are the main questions in a market research interview?

There are three types of questions you will need to ask during the market research interview. Start with icebreaker questions that will help you establish your rapport with the interviewee. Next, ask general questions related to the market, their experience with brands and products, etc. Finally, ask the core questions related to the market research objectives.

Related articles

Related articles

Related articles

Product Launch Planning Meeting Mastery: A Guide to a Successful Takeoff

Product Launch Planning Meeting Mastery: A Guide to a Successful Takeoff

Product Launch Planning Meeting Mastery: A Guide to a Successful Takeoff

Meetings

Jun 24, 2024

Status Update Meeting Mastery: A Guide to Focused and Efficient Check-Ins

Status Update Meeting Mastery: A Guide to Focused and Efficient Check-Ins

Status Update Meeting Mastery: A Guide to Focused and Efficient Check-Ins

Agile Meetings

Jun 24, 2024

Project Management Meetings: Keeping Your Team on Track and Projects Soaring

Project Management Meetings: Keeping Your Team on Track and Projects Soaring

Project Management Meetings: Keeping Your Team on Track and Projects Soaring

Meetings

Jun 24, 2024